When it comes to real estate planning and property investments, having access to accurate financial information is crucial. This is where mortgage loan calculators come into play. These handy online tools provide invaluable assistance in estimating mortgage payments, understanding affordability, and planning for future expenses.

In this article, we will explore the benefits of utilizing mortgage loan calculators for real estate planning. Whether you’re a first-time homebuyer or a seasoned investor, harnessing the power of mortgage loan calculators can be a game-changer in your real estate journey.

Introduction to Mortgage Loan Calculators: Benefits and Usage

Mortgage loan calculators have revolutionized the way individuals approach real estate planning. To begin, here’s what you need to know about what goes into the calculation of your mortgage loan:

Principal Amount – The initial sum of money you borrow from the lender (the bank or HDB depending on your loan type) to purchase your home. This amount determines the total amount you need to repay over the loan term.

Interest Rate – The percentage charged by the lender for the amount you borrowed. Lower interest rates translate to lower monthly repayments.

Loan Term – The duration over which you agree to repay the loan. In general, loan terms are 25 years for HDB loans and 30 to 35 years for loans from other financial institutions.

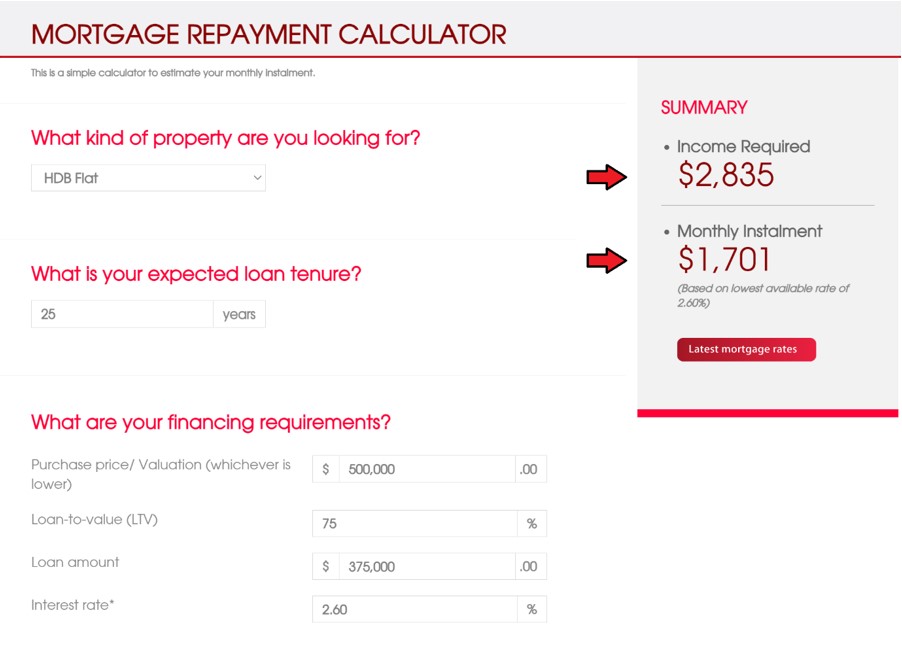

While there are many types of mortgage loan calculators available, they all serve the same purpose and are designed to help you calculate the crucial loan variables such as monthly loan repayment amount and estimating your budget for your home purchase. Simply enter these three essential variables into a mortgage loan calculator . The calculator also offers the flexibility to explore various scenarios. You can adjust the principal amount, interest rate and loan term to see how they impact monthly payments and overall affordability. Here’s an example of how a typical mortgage calculator will look like.

These calculators don’t just crunch numbers; they offer insights into various financial scenarios, making it easier for you to gauge your affordability and explore suitable housing options. Find out how much you can borrow and the amount of cash you need upfront to plan your property purchase.

Estimating Monthly Mortgage Payments: How to Use the Loan Calculator Effectively

Now that you’re equipped with a fundamental understanding of what goes into the calculation of your mortgage loan, let’s delve into the practical side of things. Here, we’ll guide you through the steps of using a loan calculator effectively.

1. Gather Your Financial Information

Before you start using a mortgage calculator, it’s essential to gather your financial information. This includes knowing the principal amount you plan to borrow, the expected interest rate, and the loan term you’re considering. Having these details at hand will ensure more accurate calculations.

2. Access a Reliable Mortgage Calculator

There are numerous mortgage calculators available online, and it’s important to choose one that’s reliable and user-friendly. Many banks and financial institutions offer their calculators, which can provide accurate results tailored to their specific loan products.

3. Input Your Mortgage Details

Once you’ve chosen a suitable calculator, start by inputting your mortgage details. Begin with the principal amount – the initial sum you plan to borrow. This figure will be based on the property’s purchase price, your down payment, and any additional costs.

Next, input the interest rate. The interest rate you enter should reflect the prevailing market rate at the time you intend to secure your mortgage. Remember that even a small difference in the interest rate can significantly affect your monthly payments.

Lastly, specify the loan term. Depending on your financial goals and the type of loan you’re considering, this could range from 25 years for HDB loans to 30 to 35 years for loans from other financial institutions.

4. Explore Various Scenarios

One of the most powerful features of mortgage calculators is their ability to explore different scenarios. You can adjust the principal amount, interest rate, and loan term to see how they impact your monthly payments and overall affordability. For instance, if you’re looking to lower your monthly payments, you can experiment with a longer loan term. Conversely, if you want to save on interest costs, consider a shorter loan term.

5. Analyze the Results

Once you’ve input all your mortgage details and explored various scenarios, the calculator will generate results that provide a clear picture of your estimated monthly mortgage payments. Pay close attention to these figures, as they are essential for your budgeting and planning.

Remember to account for other costs including property taxes, homeowners’ insurance, and maintenance expenses. It’s crucial to consider these factors when assessing your overall budget.

Assessing Affordability and Loan Options: Analyzing Different Scenarios with the Mortgage Calculator

Here, we delve into how these calculators can be tailored to different scenarios, empowering you to analyze affordability, explore loan options, and make decisions that align with your financial goals in Singapore’s dynamic property market.

1. First Time Home Buyer

For a first-time homebuyer in Singapore, the property market can be both exciting and challenging to navigate. As a first-time buyer, you may be eligible for government schemes like the HDB loan, which offers competitive interest rates and favorable terms. By using a mortgage calculator, you can experiment with different scenarios, such as adjusting the down payment or loan tenure, to find the most suitable option that aligns with your budget and long-term financial goals.

2. Real Estate Planning When Upgrading To A Larger Home

As your family grows or your lifestyle changes, you may find the need to upgrade to a larger one. Here, mortgage calculators help you assess the financial impact of this transition. You can use them to calculate the potential increase in your monthly payments, factoring in your current mortgage terms and the new property’s price. Additionally, you can explore scenarios involving the sale of your existing home and the purchase of a new one.

3. Refinancing

Refinancing your mortgage in Singapore can be a strategic move, especially when interest rates have fallen, or your financial situation has improved. Mortgage calculators enable you to estimate the potential savings from refinancing by comparing your current loan terms to new ones. You can input your existing interest rate, loan balance, and the new interest rate to see how your monthly payments and overall interest costs might change. This empowers you to make an informed decision about whether refinancing is a viable option.

Real Estate Planning

In conclusion, utilizing a mortgage calculator for real estate planning provides valuable insights into affordability and loan options. The mortgage calculator empowers you to assess the impact of variables such as loan amount, interest rate, and loan term on your monthly payments and overall financial outlook. It enables you to consider different loan options, compare scenarios, and understand the long-term costs associated with each choice. However, while the mortgage calculator is a powerful tool, it’s important to complement its usage with professional advice from mortgage specialists or financial advisors.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!