Total Debt Servicing Ratio (TDSR) is a cooling measure introduced by the Singapore government to limit individuals from spending too big a proportion of their monthly income on debt repayments. At present, the TDSR is set at 55%, after the government tightened the threshold by 5 points on 16 December 2021.

Since property loans are large liabilities for many, TDSR ensures that borrowers practice financial prudence, and are not over-leveraged for their purchases.

What is Total Debt Servicing Ratio (TDSR) used for?

Banks and financial institutions are required to follow TDSR guidelines when granting loans. This includes both residential and non-residential property loans.

Total Debt Servicing Ratio (TDSR) was introduced to prevent individuals from over-borrowing and are unable to repay their debt.

TDSR also helps in curbing property speculation. In the past, individuals borrowed large amounts of money to flip it for their profit. With the TDSR introduced as a cooling measure, this thankfully is no longer a big problem.

How is Total Debt Servicing Ratio (TDSR) calculated?

Total Debt Servicing Ratio (TDSR) is capped at 55% of your monthly income.

For example, if your monthly income is $4,500, your maximum monthly repayment is $2,475 (55% x $4,500). If you have additional loan repayments (car loan, personal loan, credit cards), it will all be counted in the $2,475. So, if your car loan has a monthly repayment of $800 and your personal loan has a monthly repayment of $500, you are left with a maximum of $1,175 per month for your home loan.

Given that you want to take a 30-year home loan at an interest rate of 4%, the approximate maximum home loan you will be able to receive is $246,000.

Let’s compare it to if you had the full $2,475 for home loan payment. The maximum home loan you will be able to receive will be a lot higher at $518,000.

This is why the more loans you take, the less you can borrow from the bank to finance your home loan.

What if I have a variable income?

If you are self-employed and earn a variable income, you will be subject to a ‘haircut’ of 30% due to the riskier nature of your job. This means that only 70% of your income will be counted towards TDSR.

Here’s an example. If you have a yearly income of $70,000, only 70% x 70,000 = $49,000 will be considered. TDSR accounts for 55%, thus your TDSR would be $49,000 x 55% = $26,950 / 12 = $2,245.83 per month. A maximum of $2,245.83 can be used to repay your debt obligations.

Can I increase my Total Debt Servicing Ratio (TDSR)?

Yes! You can improve your Total Debt Servicing Ratio (TDSR) by:

- Paying off all your outstanding payments before taking on another loan

- The maximum home loan you can receive if you pay off all your debt and use it solely for your home loan can be a lot higher!

- Check if you have any additional eligible financial assets!

- This can include cash, gold, unit trusts, shares, and stocks.

- You may be able to use these as part of your gross monthly income. With a higher gross income, your borrowing power will increase!

Who is exempted from TDSR?

Your Total Debt Servicing Ratio (TDSR) will be considered UNLESS you are refinancing your home loan for a property you are currently living in. For these borrowers, your TDSR will be waived, subjected to each bank’s internal Debt Income Ratio.

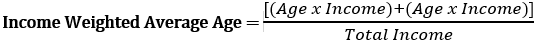

How can I calculate my maximum my loan tenure and Income Weighted Average Age (IWAA)?

In the past, you could maximise your loan tenure by applying for your loan with a younger borrower. However, this is not the case anymore. Now, the Income Weighted Average Age is used instead.

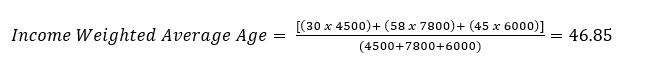

Suppose you are applying a loan under 3 names, all with different ages and incomes.

Borrower 1 = 30 years old; Gross Income = $4,500

Borrower 2 = 58 years old; Gross Income = $7,800

Borrower 3 = 45 years old; Gross Income = $6,000

The combined income weighted average age will be 47 years (rounded up).

Depending on whether you are buying a HDB or private house, the maximum loan tenure you will be granted is 25 years or 30 years, respectively.

If you are buying a HDB, the maximum loan tenure you will be granted is 25 years, or up to 65 years old, whichever is lower. Whereas, for a private property, the maximum loan tenure is higher, at 30 years or up to 65 years old, whichever is lower.

Applying the case above, the maximum home loan tenure the borrowers will be granted is 18 years (65 – 47), regardless of whether it is a HDB or private property.

Is TDSR the same as MSR?

No! MSR refers to the Mortgage Servicing Ratio. As we know by now, TDSR applies to all property. However, MSR only applies to HDBs and Executive Condominiums (ECs) purchased directly from the developer.

In addition, unlike TDSR, MSR does NOT take into account your other existing loans. MSR is capped at 30% of your Gross Income.

This means that if your gross income is $5,000, you are only allowed to get a maximum monthly loan of $1,500.

What if both TDSR and MSR applies to me?

If you are find yourself in this situation, your monthly property loan repayment will be the lower of the two.

For example, Mr Tan draws a gross income of $6,000 with an existing debt repayment of $900 per month for his car loan. His TDSR would be capped at 55% of his income, which will be $3,300 . Subtracting his existing debt off the TDSR, Mr Tan would be eligible to $2,400 for his home loan.

On the other hand, MSR is capped at 30% without taking into consideration any other loans. As a result, he will be eligible for $1,800 for his home loan.

As the loan amount is lower for MSR than TDSR, MSR will be considered.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!