At a fundamental level, owning commercial property for investment purposes is much like renting out a residential property – you, the landlord, own a property and rent it out to the tenant for monthly cash flows.

In Singapore, there are 2 types of non-residential properties: industrial and commercial properties. Firstly, commercial properties include retail shops, offices, medical suites and shophouses. Secondly, industrial refers to workspaces such as B1 (offices, warehouses) and B2 (factories).

If you are considering buying a commercial property in Singapore, here is a guide on things that you need to know before you decide.

Who can purchase a commercial property?

Within the commercial property market, Singaporeans, Permanent Residents and foreigners are allowed to purchase commercial property.

Advantages of buying a commercial property

1. Not subjected to Additional Buyer’s Stamp Duty (ABSD)

Buying residential properties in Singapore involves paying ABSD if it is your second or subsequent property. This was introduced as a cooling measure to discourage people from purchasing additional properties for speculative purposes. ABSD ranges between 7 to 20 percent, depending on a variety of factors (such as your residential status), which also represents a significant outlay.

Purchasing commercial properties will not be subjected to ABSD, which means they are more attractive as an investment asset.

2. Not subjected to Seller’s Stamp Duty (SSD)

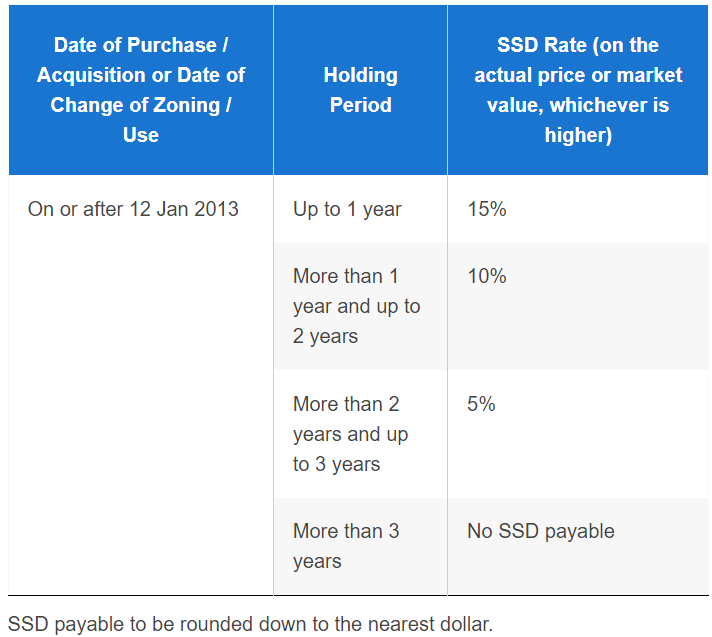

SSD is applicable for residential properties bought on or after 20 February 2010. This tax can go as high as 15 percent if a property owner is looking to sell the property within one year of having bought it.

Selling commercial properties will not be subjected to SSD, except for some industrial properties such as your B1/B2 industrial factories based on the holding period.

3. Potential for higher rental yields

For residential property, rental yield typically ranges between 2% to 5% whereas for commercial property, yields are typically much higher at 5% to 10%. In a recent Straits Times article, JLL also commented that they expect Grade A office rents to continue their climb, potentially gaining 23 per cent to 30 per cent by 2025.

Such difference in yields largely stems from the duration of lease agreement where residential tenancies tend to run between 1-2 years while commercial properties are occupied by businesses where lease agreements usually span more years with some as many as 10 years lease agreement as businesses sought stability.

4. Subjected to less tax payables

If you are buying commercial property purchase through a company rather than in your own name, you may be subjected to less tax payables. This is because the corporate tax rate in Singapore is a flat 17% while personal tax can go much higher depending on what your income is.

And from 2020 onwards, all companies in Singapore will be granted a 25% corporate income tax rebate subject to an annual cap of S$15,000 thus newly registered Singapore companies buying a commercial property can enjoy this if the property is let out for rental income.

5. Exemption from Total Debt Servicing Ratio (TDSR) Limitations

Similar to residential property, owners of commercial / industrial property are subject to TDSR limitations of 60% if they choose to purchase under individual name. As a safeguard, the TDSR applies to all loans across your portfolio, which may impair your ability to leverage on future opportunities.

In the case of purchases through corporate entities, a proven track record of strong balance-sheet management may exempt you from the TDSR, thereby giving you greater flexibility to take on opportunities as they arise.

Additional factors to consider before you purchase a commercial property

In considering what type of commercial property to purchase, we list some additional factors to consider as you conduct the relevant market research.

1. Type of tenants

The unique tangible aspects of your commercial property will be vital in commanding high rental rates while attracting high quality tenants which will ensure stable cash flows over the given tenure, while also providing a greater possibility for you to realise capital gains in the future.

If you have experience in the warehousing or logistics industry, you may have a better idea of the logistics market and would hence know what type of tenants would pay a premium for the space you choose to purchase. Since different businesses may require property for different uses, it is important to check the zoning restrictions for that given property since its intended use may be difficult to change.

2. Location

Location is a fundamental aspect in all real estate decisions. For retail properties, being close to transport nodes like MRT stations may result in a higher footfall. However, certain out-of-reach areas may also add to the ambience of F&B outlets.

The location of stores within the shopping mall also impacts the rent that the unit commands. For instance, corner units or units on lower floors tend to draw customers as they are the first stores that visitors see when they enter the mall. It is for this reason that large companies like Nike and Apple carefully select these prime units.

3. Financing

Financing options differ between individuals and corporate entities. As an individual, you are subject to the TDSR which is set at 60%, on top of servicing other loans within your portfolio. As a corporate entity, your company will be evaluated on a case-by-case basis, to determine if your net operating income can support your future debt repayments.

The high-value nature of real estate demands a careful decision-making process. More importantly, financing options play an integral role in the final decision as interest rates and long periods of vacancies may place the owner under immense pressure.

4. Leasehold

Leaseholds for commercial property typically range from 30 years leasehold, 60-year leasehold, 999- years leasehold, and freehold. Industrial sites with shorter leasehold are more affordable for business owners in Singapore. It aims to curb investors speculating in the commercial properties space where most would prefer industrial properties with longer leases. In turn, this also gives flexibility for the government in terms of redevelopment of land.

These are just some of the many decisions that go into deciding on purchasing a commercial property. We strongly recommend conducting a thorough research on the real estate market before taking the plunge.

Do reach out to Redbrick Mortgage Advisory for tailored solutions regarding your next move in real estate investments!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!