Following the announcement of cooling measures for the property market, the shares of many property firms have fallen. But is there really a cause for concern for buyers like you? Or are the cooling measures likely to just have a short-term impact on our property market? This article dissects the 3 main cooling measures that would affect you and predicts who it would have the heaviest impact on.

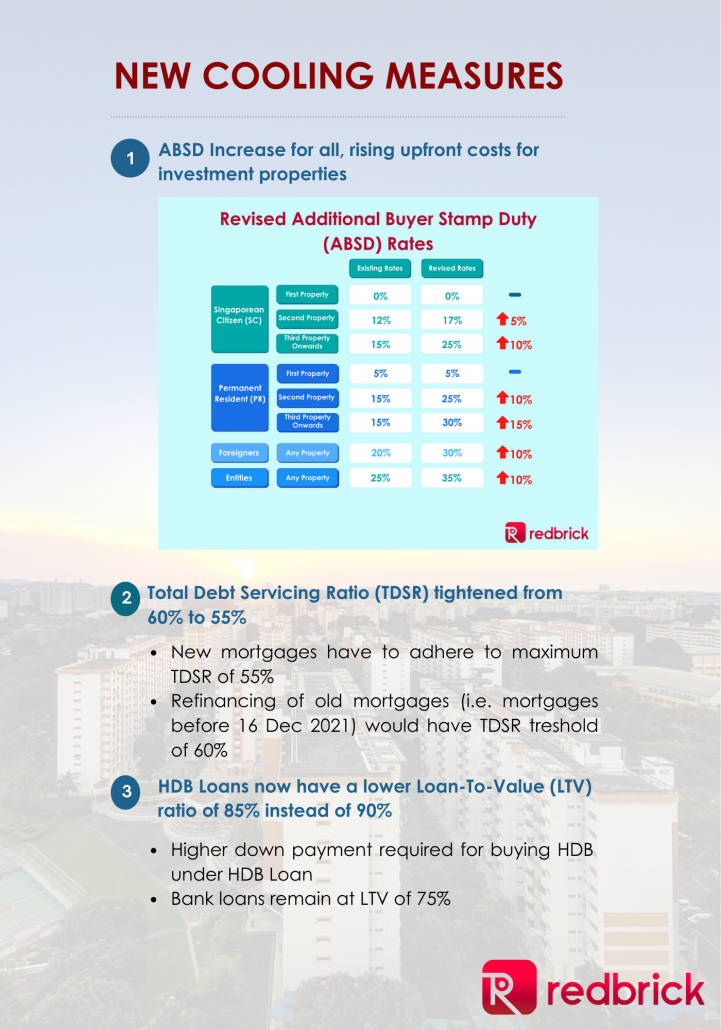

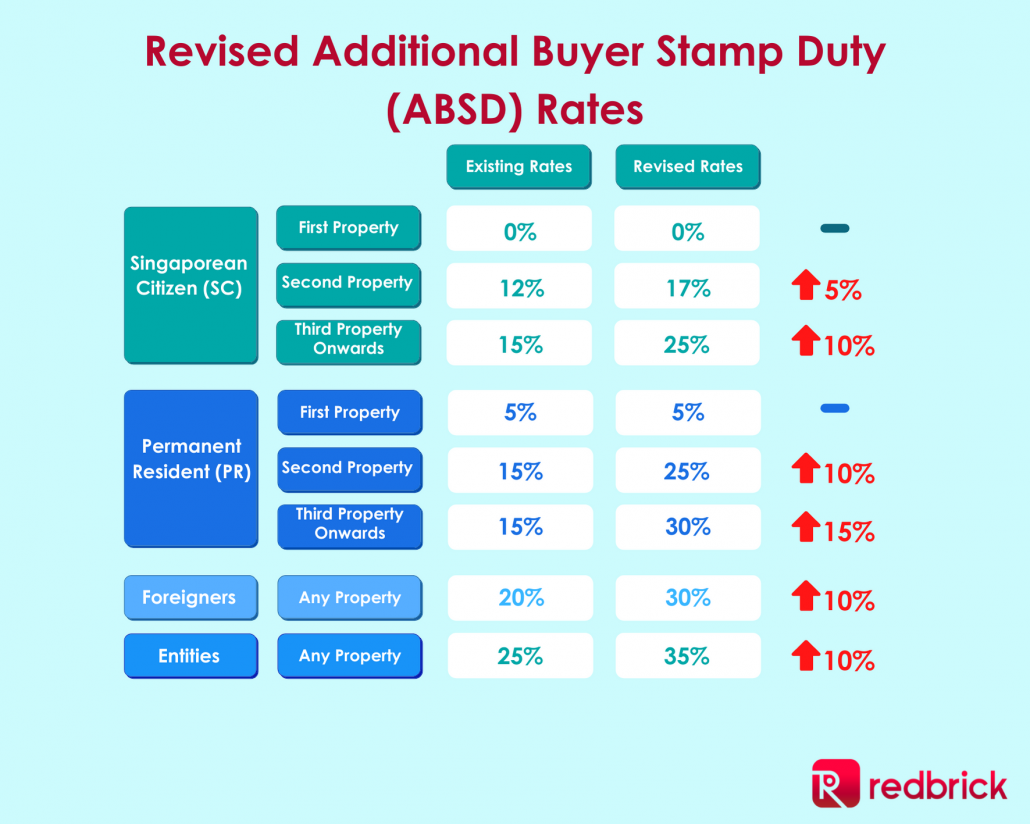

1. Hike in Additional Buyer Stamp Duty (ABSD) rates

If you are looking for your first home to stay in, this measure is likely to have minimal impact. On the other hand, if you are a Singaporean or Permanent Residents (PR) looking for 2nd property and subsequent properties, the hike in ABSD rates is like to result in a substantial rise in the upfront costs for you!

For instance, a Singaporean couple purchasing a residential property of $1.5 million would have to pay $375,000 if it is their 3rd and subsequent property. Assuming they can secure a 75% Loan-To-Value (LTV) ratio for their property, the down payment would also be $375,000. Even without considering BSD, conveyancing fees and other costs, the numbers show that a hike in ABSD would cause upfront costs to surge.

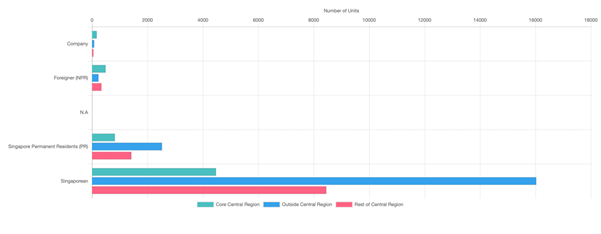

As for foreigners, they only make up a small proportion of the residential market buyers. From our research on REALIS, the bulk of residential property market buyers are made up of Singaporeans and PRs.

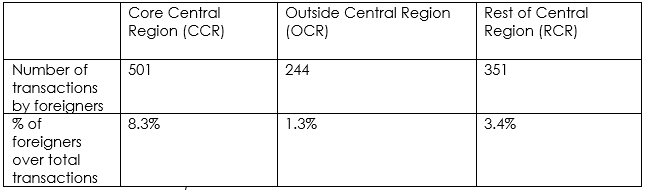

Out of a total of over 35,000 private residential transactions in 2021, only 3.1% are foreigners. On the other hand, Singaporeans make up 82.3% of the market and PRs make up 13.6% of the private residential market. Thus, it is fair to say that the well-targeted measures would affect Singaporeans and PRs looking for investment properties the most, given the insignificant proportion of buyers who are foreigners.

If we take a closer look at the foreigners’ transactions, the majority is in the Core Central Region (CCR), followed by Rest of Central Region. In other words, foreigners primarily own housing in the central regions, such as River Valley, Novena, Farrer Park and Tiong Bahru areas.

Furthermore, as shown in Graph 1, there are barely any entities buying residential properties in today’s climate due to unfavorable regulations. Since this group no longer exists, the hike in ABSD rates is unlikely to cause any impact.

2. Total Debt Servicing (TDSR) Ratio falls from 60% to 55%

A typical family would have a TDSR of 45% to 50%, after considering their existing loans. If the property purchase is your personal residence, there should be minimal effect on your finances. On the other hand, if you are looking for investment properties in the residential market, this measure would cause you to have vastly different loan amount eligibility.

Example

Mr. Tan and his family with an Income Weighted Average Age (IWAA) of 40 years old has a household income of $10,000 and a car loan of $1000 monthly installments.

Prior to the change in cooling measures, they would have been eligible for a maximum loan of $989,000 assuming a loan tenure of 25 years.

After the change, with the same loan tenure, they would only be able to have a maximum loan of $898,000.

Although the tightening of TDSR is merely 5%, this would result in $100,000 of loan difference for Mr. Tan and his family. This means that Mr. Tan would need to fork out additional $100,000 upfront for the down payment which he could have spent in other investments. However, not all hope is lost. If you are in a similar situation with Mr. Tan, you could consider speaking to one of our mortgage advisors to advise you on your situation.

3. Fall in Loan To Value (LTV) Ratio for HDB Loans

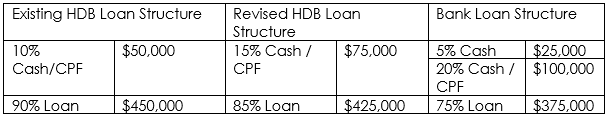

LTV refers to the loan quantum in proportion to the purchase price of the property. With the fall in Loan To Value (LTV) ratio from 90% to 85%, this would mean that buyers like you would need to have more cash on hand for the higher down payment.

Example

For a HDB purchase price of $500,000, the down payment would increase from $50,000 to $75,000 and the loan quantum would fall from $450,000 to $425,000. While $25,000 may not seem like much, this could have a big impact on younger couples who have lesser savings and are looking for a higher loan quantum for their first home.

On the other hand, bank loans still have an unchanged LTV of 75%. The difference in loan quantum offered by a bank and HDB has fallen from a difference of 15% to 10%. Since many who prefer HDB loans over bank loans typically wish to pay a lower down payment, such a scheme could make a portion of HDB buyers turn to bank loans instead.

While this fall in LTV means buyers of HDBs must have more cash in hand ready for their down payment, and not solely rely on the HDB loan, it is likely to have minimal impact for families who are closer to the cap for eligible income amount for HDB loans. Under HDB Loan Eligibility (HLE), applicants must have a household income of $14,000 or lower to be eligible for HDB Loan.

This group of buyers with relatively higher income is likely to be the bulk of the buyer market for HDBs in the central region. Therefore, the tightening of LTV for HDB loans is likely to hit the HDBs in prime areas are likely to the hardest.

Our Predictions

While many have speculated the implementation of cooling measures, not many expected the dramatic change in rates. Regardless, condominiums sitting on prime location have been and will always remain high in demand. Furthermore, developers cannot afford to slash prices as cost of construction continue to climb. Even if prices were to stabilize or even fall, this is likely to be a short-term impact in land-scarce Singapore. We believe that property prices are likely to still grow in the long-term.

Such cooling measures would only serve to curb the growth of the property market and not have any impact on the appreciation of private properties in the long term. If any of the above measures has affected your upcoming property purchase, you may want to speak to our mortgage advisors for personalized advice.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!