Russia’s ongoing invasion of Ukraine has dominated the headlines, with more and more sanctions being announced as the assault continued.

Russia had taken offence at Ukraine’s bid to be part of the European Union (EU) and the North Atlantic Treaty Organization (NATO) and moved to stop it.

Even though a full-scale invasion was the least cost-effective method to get their requests heard, Unicorn Financial Solutions believe Russia was clear of the risks and rewards of their strategy and are prepared for the sanctions which might most probably hurt the Eurozone more than Russia.

What prompted Russia’s move?

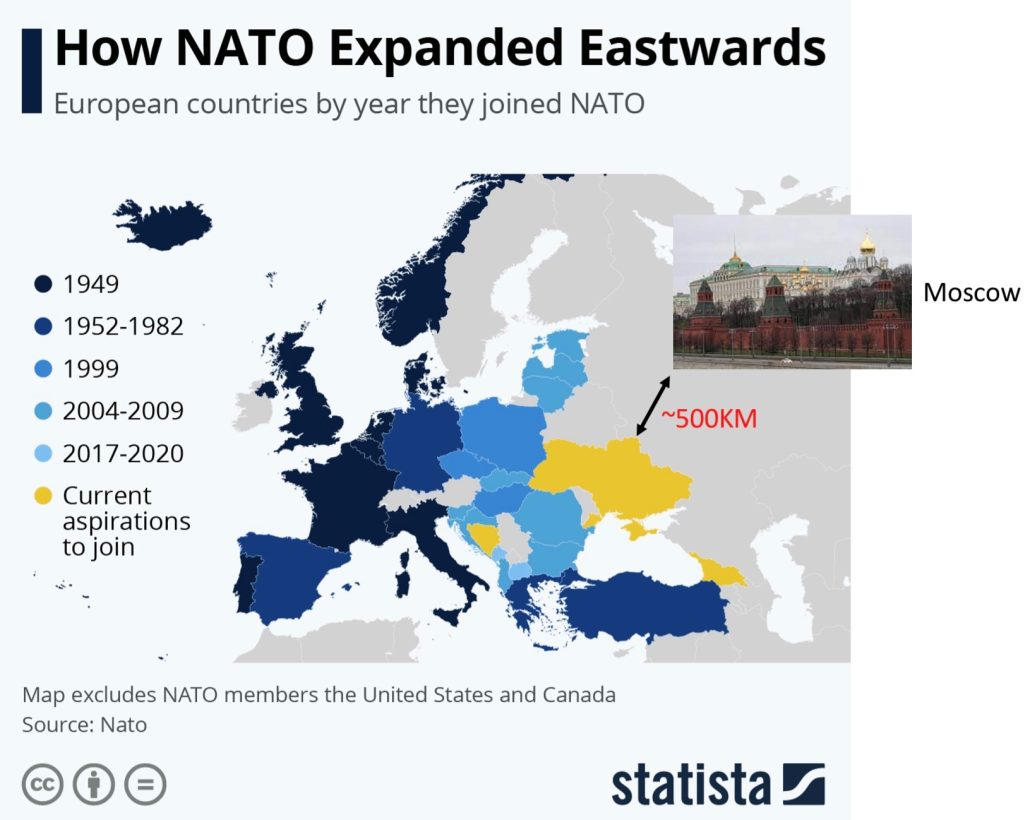

The Russian government had feared that Ukraine’s membership in the EU and NATO will “complete a Western wall of allied countries” united against it by restricting Russia’s access to the Black Sea1. If it happens, Moscow would only be about 500km away from the nearest allied country where NATO weapons and forces could be positioned.

Russia views NATO’s intention to offer Ukraine membership as a hostile act, even though Ukraine is much weaker in terms of military prowess.

What are Russia’s requests?

As Russia perceived the above as threats to national security, they are requesting for:

1. NATO’s guarantee that Ukraine will never be allowed to join NATO

2. NATO to move forces and weapons out of the allied countries that joined after 1997, as well as refrain from deploying troops to these areas

3. NATO to reinstate the Intermediate-Range Nuclear Forces Treaty

4. The US and Ukraine to follow through on the Minsk Agreements signed in 2014 and 2015, as well as for autonomy to be granted to eastern Ukraine.

Impact of sanctions

Europe also depends on Russia for about one-third of their energy needs, while Russia had been building up its financial shield to be more resilient against possible sanctions. Russia has built up US$640B in reserves3, and this probably meant that the current sanctions could impact Europe more than Russia.

Is it an opportunity or an adversity?

Looking back at the major conflicts over the years, i.e. the Gulf War, the Iraq War, and the 9/11 attacks, the Dow Jones Industrial Average (DJIA), representing the US market, had corrected between 6 – 16% when they broke out, and usually recovered between 1-8 months. And through the periods of military conflicts (inclusive), the DJIA has increased 600% over the last 30 years.

Unfortunately, wars cause insufferable pain and had also roiled the market in the short-term. They, however, did not alter the existing economic situations, and would usually create a window of opportunity to invest. Hence, our existing strategy of “1-step back, 3-steps forward” enacted prior to this war and the window of opportunity remain intact, except it may mean a greater opportunity in the initial period if this war exacerbates the decline in stock prices. And Unicorn think it’s important to hedge your portfolio well with safe haven asset classes and be ready to pick up good buys as the equity markets correct.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!