What do marshmallows have to do with investing?

Apparently a lot!

In the 1960s, the Stanford psychologist Walter Mischel carried out experiments with marshmallows for 4-year-olds, giving them an option to eat their favourite treat immediately or to double the treat if they were willing to wait.

And the children were tracked for 40 years, and over and over again, the researchers found that the children who delayed their gratification succeeded in whatever capacity they were measuring – the children grew up to have better relationships, made more money, and were happier and healthier.

Investing and Delayed Gratification

Besides winning in life, Charlie Munger, Warren Buffett’s partner in investing, also said this: “It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

“You don’t rush a winemaker during the maturation process, you don’t rush an engineer building a bridge and you certainly don’t rush a surgeon performing open-heart surgery. All of these professionals need time to do their job right.” Your wealth also grows the same way, and you can utilise dollar cost averaging in the same manner, putting aside the same amount of funds into an investment each month.

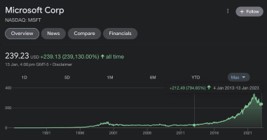

If you had started buying Google’s and Microsoft’s shares 10 years ago, you would have gained almost 400% from Google and 800% from Microsoft – investing is a game measured in decades, not weeks.

However, this cannot be achieved if you have sold them after 1 year to pocket a 30-50% gain.

And this gain is due to the magic of compounding. Their business have grown over time, and thus your savings and investments over the years also grow and compound.

Compounding can make you a millionaire, when you are willing to wait, and yet it saves you a lot more time. For example, putting aside $15,000 a year would accumulate $1.5M in 30 years’ time, assuming a 7% ROI per annum – shaving off 70 years from saving the same amount.

How to decisively and systematically invest

You might be asking: “How much can I invest? How long to do so? How much investment return do I need?”

It is impossible to decisively and systematically invest without having these questions answered by your personalised financial plan. In Unicorn, investing does not start with crafting an investment portfolio, but the crafting of a personalised financial blueprint, for each and every client.

This blueprint serves as a GPS so that clients have a clarity of where exactly they are, financially, and how best to achieve their financial goals, according to the desired timeline and financial capacity, while taking into account their tolerance to volatility as well as external economic conditions.

Figuring out your investment philosophy, strategy and plan

A sound and well-tested investment philosophy and strategy gives you the compass to navigate through the “noisy” investment jungle. In Unicorn, our investment is grounded on time-tested value investing philosophy.

Value investing involves buying assets at attractive prices relative to their appraised value. For equities, we ascertain their productive value based on the quality and growth of their underlying business. And it also requires time, because the asset prices may not always reflect their value in the short term, but in the long term, they converge. As Benjamin Graham, the father of securities analysis, said, “In the short run, the market is a voting machine. But in the long run, it is a weighing machine”.

Conclusion

“When you plant a tree, you give it time to grow while the sun and rain nourish it. You don’t keep digging up the sapling to check its roots, and you don’t panic in the winter when the leaves fall because it’s just part of the natural cycle2.”

The global stock markets have declined between 17-50% from their recent peaks. To value investors like us, this is great news as it is putting stocks on discount again.

The stock market is a very strange place as it is the only place where people become distressed when prices get more and more attractive.

This is because they often look at the price as it is, rather than through the lens of value investing. If you are feeling unsettled because of the price correction in the global stock market, it is probably time to give your financial consultant a ring to revisit your financial plan and investment philosophy, so that you can make the right decision for yourself in such turbulent times. We believe that having the fortitude for delayed gratification via a sound financial plan and investment philosophy is the assured path towards financial success.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!